Renovation loans are monetary goods designed to support homeowners finance the expense of house enhancements and renovations. In Singapore, these financial loans cater specifically to folks wanting to improve their living spaces, no matter if through structural modifications, aesthetic upgrades, or important repairs.

Critical Features of Renovation Financial loans

Loan Quantity

Usually ranges from S$5,000 to S£thirty,000, according to the lender.

Some financial institutions may possibly present as many as 6 instances your month to month revenue, topic to eligibility.

Interest Rates

Desire premiums can differ drastically amid lenders.

Usually fixed or variable; ordinary premiums vary from three% to five% per annum.

Repayment Interval

Normally spans among one 12 months and 5 yrs.

Versatile repayment options may very well be readily available depending on borrower desire.

Eligibility Requirements

Should be a Singapore citizen or long-lasting resident.

Bare minimum age need is usually all-around 21 several years aged.

Proof of earnings and creditworthiness is essential for loan approval.

Disbursement Process

Money are often disbursed in phases based upon renovation progress.

Homeowners may well really need to present invoices or receipts from contractors for reimbursement.

Sorts of Renovations Covered

Renovation loans can protect a big range of projects which includes:

Kitchen area remodels (e.g., new cupboards, countertops)

Toilet updates website (e.g., fixtures, tiling)

Living room enhancements (e.g., flooring, lighting)

Structural alterations (e.g., incorporating partitions or extensions)

Software Process

Study Lenders:

Assess unique banking companies and financial institutions for competitive interest prices and terms.

Obtain Documentation:

Identification documents

Proof of earnings

In depth renovation strategies with approximated charges

Submit Application:

Complete the applying variety furnished by your picked out lender along with required documentation.

Acceptance & Disbursement:

On approval, money will either be released straight to you or managed as a result of your contractor as do the job progresses.

Simple Guidelines for Taking care of Your Renovation Personal loan

Make a detailed spending budget that outlines all envisioned charges connected with renovations.

Keep track of all receipts and invoices during the renovation system for clean reimbursement claims.

Connect Obviously with contractors concerning timelines and payment schedules joined with mortgage disbursements.

By comprehending these components of renovation loans in Singapore, homeowners can make knowledgeable conclusions about financing their home enhancement projects proficiently whilst making sure they stay within just spending budget constraints!

Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Kelly Le Brock Then & Now!

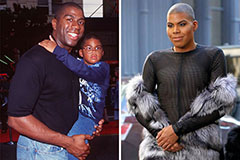

Kelly Le Brock Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!